Nordic tech in Q4: the most active quarter so far

In Q4, tech startups based in Nordic countries collectively raised $309.8 million in 107 rounds. Though not the biggest quarter of 2015 in terms of amount raised – a distinction still carried by Q2 and its massive $812.8 million cumulative intake – it is the top quarter for amount of individual investments, by an easy 40 rounds.

This funding analysis of Q4 investments in the Nordics is based on a combination of publicly available and proprietary data gathered by Index.co, and focuses solely on tech-startups currently headquartered in the Nordic region.

Breakdown by country

Unlike last quarter, which was fairly unbalanced in terms of rounds contributed to the total, Finland, Denmark, and Sweden are at the top for the amount of rounds in Q4. The breakdown by dollar amount, however, tells a different story.

Iceland, which was absent from last quarter’s roundup, has come soaring back. It not only nearly matches Finland’s contribution, but did so with only 9 rounds compared to Finland’s 21. Coupled with the fact that Iceland accounts for 14.77% of the total, whereas Norway put in 5.62%, Iceland’s performance really shines.

In the previous analysis we predicted that the newly established Frumtak 2 and Brunnur funds in Iceland would make up for Iceland’s absence in the funding scene in Q3. The prediction seems (at least partially) to have been accurate.

Realistically, both Iceland and Finland’s numbers are somewhat skewed by clear outliers, like CCP Games’ $30 million round in Iceland and Kiosked’s $15 million round in Finland. When accounting for these, the difference is more slight, with Iceland raising $12.2 million in 8 rounds, and Finland $24.7 million in 18 rounds.

Sweden remains the clear leader in the region for startup investment activity, contributing 28.62% of the total in 49 rounds, at $88.4 million raised cumulatively. Norway performed similarly to last quarter, bringing in a total of $17.4 million.

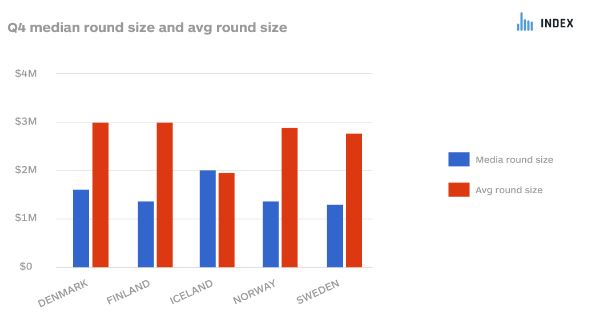

Relative round sizes by country

There were some notable outliers in the funding rounds in Iceland, Finland, and Denmark. When these are accounted for, we can see again that Iceland is more than pulling its weight this quarter, with the highest median amount at $1.99 million. Denmark held the highest average round size at $3.02 million.

The story that the numbers tell is that, for the most part, there’s a healthy amount of variance in the sizes of investments happening in the region, with a stable early stage base and the necessary big later-stage rounds pulling up the averages.

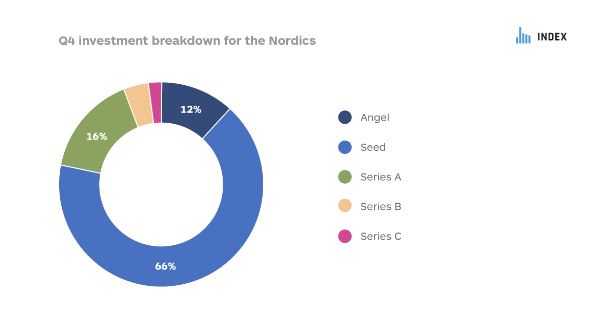

Q4 by stage

The breakdown of funding rounds presented here discounts undisclosed and late-stage (post series C) funding rounds. The total amount of rounds is 51. Pre-seed and Seed stage investment account for 78% of the round types in Q4. However, more of these are Seed rounds than in Q3, which hints at a maturation trend in the region. Later stage funding in the range of series B and C are still few and far between.

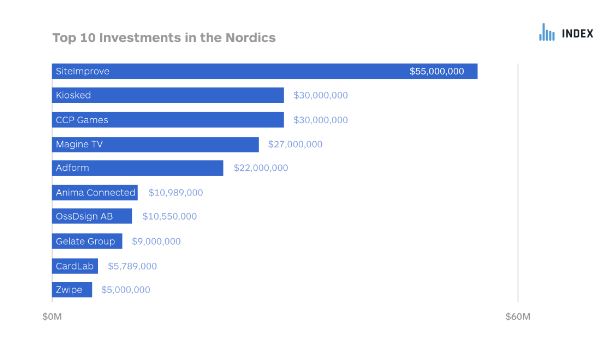

Top 10 investment rounds

Unsurprisingly, three of the top ten investments this quarter were collected by Danish companies, matching Sweden’s three places. Norway takes two places in the top ten, and Finland and Iceland each take one. However, to make up for it, these rounds were the second and third largest, respectively ($30 million each).

Top 3 by country

Denmark

The top three investments in Denmark this quarter went to Siteimprove ($55M round), a web governance platform, Adform ($22M round), a display advertising platform for publishers and agencies, and CardLab ($5.7M Series A), a card technology company specializing in retail loyalty cards.

Finland

Crowning the ranks in Finland are Kiosked ($30M Series B), an omni-channel advertising platform, Umbra ($3.4M round), 3D middleware for the gaming industry, and ICEYE ($2.8M Series A), a satellite-powered imaging company.

Iceland

Iceland’s top three rounds went to CCP Games ($30M round), a games studio famous for EVE Online, ARK Technology ($2.3M round), and environmental management company for the maritime industry, and Sólfar Studios ($2.1M Seed round), a virtual reality games studio.

Norway

Norway’s biggest investments went out to Gelato Group ($9M round), a 3D printing cloud network, Zwipe ($5M Series B), a biometric payments company, and CrayoNano AS ($2.3M Seed round), a semiconductor materials company.

Sweden

Sweden’s champions this quarter were all in the top 10 as well. The rounds were hauled in by Magine TV ($27M Series A), a cloud-based TV operator, Anima Connected ($10.9M round), an IoT company with a yet-to-be revealed product, and OSSDsign AB ($10.5 Series A), a medical device company that makes cranial implant

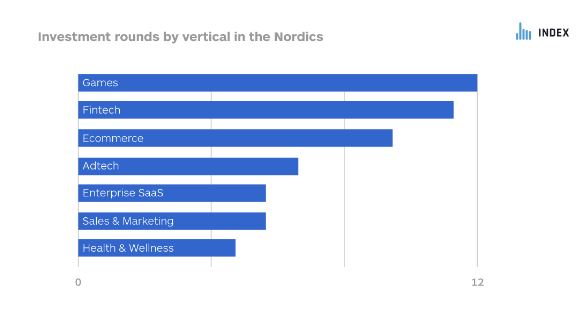

Breakdown by vertical

Most investments this quarter were made into gaming and fintech companies, with 12 and 11 rounds respectively. Gaming and fintech companies were much more prevalent than last quarter, coming up from 4 and 5 rounds. Other verticals have remained relatively stable, not making up much more or less of the total investments than last quarter.

Conclusion

Fintech was predicted to be the next big thing for the Nordics, and 2015 proved it. Sweden now has an established footprint in the fintech scene and was recently named one of the European fintech hotspots, while Denmark’s Copenhagen Fintech Innovation and Research (CFIR) is working to establish a fintech cluster in Copenhagen. And in Norway, the fintech scene has been rapidly growing and capturing a large share of VC investment. It is unlikely the momentum in this sector will slow down, as even traditional banks have moved into this rapidly diversifying sector.

The Nordic countries have continued their strength in the gaming industry, with the investments in Q4 coming on the tail of a number of high-profile acquisitions, most notably King being acquired for a whopping $5.9 billion by Activision Blizzard.

This quarter was record-breaking for the number of investments, but as always, the vast majority of them were at the early-stage. The Nordics still suffer from a bottleneck in later stage investing, which has been attributed to a cultural aversion to risk.

Additional reporting provided by Lisa Mallner and Nordurskautid.