The vacation rental portal, SunnyRentals.com, was bought last year by their competitor Vacasol. The acquisition came after SunnyRentals has had a deficit for several years, but that does not mean the investment was bad.

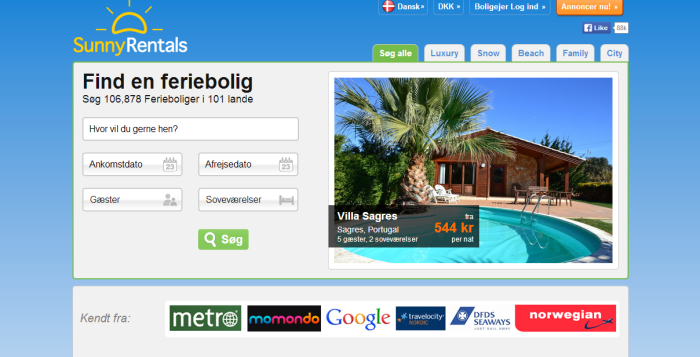

SunnyRentals, founded in 2009, has been acquired by Vacasol, which has facilitated online booking of vacation rentals throughout Europe. The Danish Vacation rental portal SunnyRentals.com had more than 100,000 vacant rentals in 100 countries worldwide. Vacasol has more than 120,000 vacation rentals in one place, after their acquisition of SunnyRental.

Enables the use of economies of scale

We had a talk with Brian Jensen, CEO of Vacasol.dk, who told us why Vacasol decided to acquisition SunnyRentals.

“Vacasol bought SunnyRentals to unite private landlords and rental agencies under one concept. Vacasol has built more than 200 independent rental agencies th

roughout Europe, and aim to diversify the available rentals as well as reap the benefits of economies of scale by buying SunnyRentals.” Explains Brian Jensen and then continues:

“The new acquisition results in a greater efficiency and optimization of our processes. We gather all the core competences under one roof, and we will be able to provide a united and stronger marketing and development effort.

A study done by SunnyRentals back in May and June 2014, shows that almost 4 out of 10 Danes make their own vacation plans instead of ordering prepackaged charter holidays. This is one of the developments, which Vacasol’s acquisition of SunnyRental is supposed to support.

SunnyRentals was steeped in deficit

If you look at the annual financial statement from SunnyRental, it shows that the company was having a steady increase in operation losses. That does not necessarily mean that SunnyRental has been a bad business.

In the financial statements, it appears that the company has invested heavily in growth. According to Brian Jensen, the equity has been partially restored in connection with Vacasol’s acquisition of SunnyRental, and the overall group’s equity is positive.

Jacob Bratting Pedersen, Partner at the venture capital, Northcap, explains that a company that runs a deficit is not necessarily a bad business.

A company can still be valuable even when it is running a deficit

“The fact that a company is running with a deficit for a period is quite typical in venture-backed companies. It is no wonder that many have difficulty understanding how i

t is possible to create value without making a profit.” Says Jacob Bratting Pedersen.

Jacob mentions Zendesk, which is listed on the New York Stock Exchange with a valuation of 16 times the company’s annual sales, even though they are running with a deficit.

“The reason why investors are willing to give such a valuation must be found in the company’s business model. The fact that they have software as a service and that the company is continuously growing, with an annual growth of 76%.” Explains Jacob Bratting Pedersen and continues:

If we, for convenience sake, says that it costs one penny to create one penny more in revenue, and that every added penny provides an added value of $16 for the company. Therefore, it makes sense to continue to invest to maintain the growth.

Jacob Bratting Pedersen recalls that companies that have software as a service, tends to have the highest revenue, and is often able to turn a profit if it compromises with the growth. Investors are aware of this, and that is why he believes that a deficit is tolerable as long as the there is a continuous increase in the revenue.

Nordic Startup News Early Stage Startup News From The Nordics

Nordic Startup News Early Stage Startup News From The Nordics