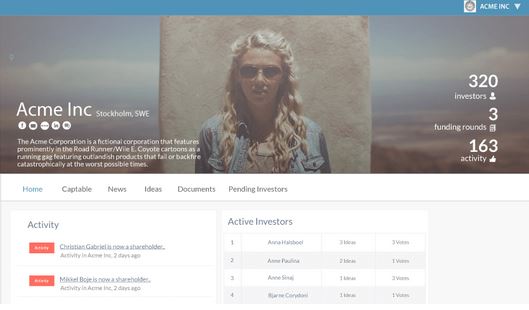

As the economy created by alternative finance expands, services like Capdesk will become an essential tool for investors. Capdesk is a shareholder platform that improves the experience for shareholders of unlisted companies by gathering all investor activities in one place.

Although currently only a small percentage of people buy shares in unlisted companies (companies not listed on the stock exchange), this number is expected to grow as alternative finance such as peer-to-peer lending and equity crowdfunding platforms gain traction.

We talked to co-founder Christian Gabriel about how alternative finance will reshape today’s vulnerable financial world.

How did you come up with Capdesk?

Casper and I have been working with Equity Crowdfunding for the last 3 years, both as a Danish managers of FundedByMe and as co-founders of consultancy Heartreacher. Our work was primarily focused on attracting capital to early stage companies. Most often our work would be done after 60-90 days of fundraising and if successful we would have helped the company to attract a 100 new shareholders.

Our work would be done and we would leave the entrepreneur with a spreadsheet of listed investors and contributed capital. There is just something absurd about innovative companies 3d printer, drones and bitcoin markets raising capital through the internet and then end up managing those investors through a spreadsheet and a mailing list.

With Capdesk we are trying to streamline the post-investing process and collaboration between founders and investors.

How do you see such products as Capdesk fitting into the future of alt-finance?

Products and services such as Capdesk will be an essential part of the new economy created by alternative finance i.e. equity crowdfunding and peer to peer (p2p) lending. It is difficult to say where democratization of finance will end, but we see some clear trends: Finance, especially equity finance is becoming available for more companies all over Europe and in the United States. Non-accredited investors are starting to invest in unlisted shares and companies to which they never had access before. Combined with the development of collaborative economy we will see new forms of companies with organizations that are much more flexible than today. This also goes for their investors relations.

Being an investor or shareholder is under transformation and hopefully we will see much more constructive partnerships than what is characterized by modern day stock markets.

There are still a lot of regulatory issues concerning crowdfunding – in 2015 countries like Spain, Italy, and Germany adopted crowdfunding rules, and the US securities and Exchange commission issues a new regulation governing equity crowdfunding as part of the JOBS act. Do you have opinions yourself about how crowdfunding should be regulated?

But I think it is great to see the US finally allowing non-accredited investors to invest in early stage companies. I don’t think it made sense to do the distinction accredited – non-accredited investor. The only thing it did was to exclude a lot of people from interesting investment opportunities.

The rich are investing to earn money, why not everyone else? Is a millionaire losing $1M better than the middle class losing $10K? It does not make sense to regulate the investment market based on income when there are so many other factors to be included in investing.

An example: Why is a guy who inherited a lot of money, but without any mechanical background allowed to invest in a auto-maker, when the mechanic who is dealing with cars every day, cant invest just because he does not have a net worth of $1 million?

At the same time I do believe that some regulation is necessary. I am still unsure when equity crowdfunding will get the real breakthrough. Some of the up-front costs are still very high and the limit of only raising $1M USD might make equity crowdfunding uninteresting to some companies, especially the ones with an existing track record.

I think there is a lot to be done with Know Your Customer (KYC) and I hope future regulation will focus a lot more on how to understand their customer. Platforms should also follow and disclose their companies success rate. How many have done uprounds, downrounds. How many exits. How many still exist. How many have paid out dividend. This would give investors a fair chance to evaluate their own chances of success. Also platforms have the possibility to nudge investors into more risk aware investing habits. This can be done by recommending a diverse portfolio in terms of industry, stage and investment types.

In short I hope: Regulations not to distinguish between accredited and non-accredited investors, regulations will make it cheap for companies to comply with regulation, and that platforms taking more responsibility within KYC, educating investors and disclose track records on previous deals.

As a shareholder platform, what sorts of regulations most affect your business?

Mostly national laws on corporate housekeeping and how to keep an investor registry. There is no uniform legislation in the EU. Some places such as Denmark and Sweden there are no standards. It is up to the company it self to maintain a record of ownership. And other countries have standards that a system needs to live up to.

One of the main issues with crowdfunding is a lack of checks and balances to maintain accountability. In many places equity investments are limited to accredited investors. Capdesk has goals of working towards transparency and accessibility – how does it specifically address this?

Accessibility and transparency in Capdesk is about enabling investors and founders to come together to work for the greater good of the company. It means giving investors many short updates about the status of the company i.e. if you sign a new client you take a photo and share it with the investors when you drink the champagne.

It also means transparency towards the company´s use of finance, budgeting, product development and other things that are relevant to investors. Also it means that a company should always show shareholders their current dilution, their value of shares, their current amount of shares, have the company been raising funds on a higher or lower valuation since their investment? What type of share classes exist in the company. Even though this can be data hard to digest. It is our goal to let investors of all types gain access to this.

However, we also see the current challenges with authentication as a potential market opportunity for Capdesk. We want to collaborate with existing platforms and we know the investors.

How do your investors interact with their portfolio companies differently than traditional investors?

Investors investing in equity crowd funding are not that different from stock market investors. The underlying fact is that they are like everyone else investing to get a return on investment. Nobody likes to lose money.

What is interesting in early stage investing is that investors are aware of the risk involved – many characterize the investment as “play money”. What is interesting about “play money” is that there is an expectation of experience attached to it. An experience is the potential to follow the risk taking entrepreneurs first hand and take part in their struggle to make the business a success.

Most investors are willing to assist with their own network, favors and even more money if the can see that entrepreneurs are fighting and hustling every day to make the business successful. But creating those synergies depends on the entrepreneurs ability to update investors and create those underlying alliances. Some companies are great at it while other struggle. We want to make it easy for all companies to achieve those positive effects of investing in unlisted shares.

Nordic Startup News Early Stage Startup News From The Nordics

Nordic Startup News Early Stage Startup News From The Nordics