With his background in developing SMS services, Daniel Döderlein was annoyed by the fact that money could not change hands as easily and quickly as sending a text message. Döderlein decided to figure out why.

The idea of sending and receiving money instantly using your mobile phone came to Döderlein in the summer of 2006, about a year prior to the iPhone being launched. “I remember how I stared down on my Nokia phone, wondering how I could make money move as fast as text messages,” says Döderlein, 36.

Döderlein’s keen thinking came from the fact that he has always been a problem solver and a doer ever since he started his first company at the age of 17. “I went to the Rudolf Steiner School and credit it for stimulating my diverse thinking. I have both won and lost in business and value my losses higher than my wins. It’s easier not to make the same mistake twice than to replicate wins,” says Döderlein.

Döderlein roped in Kjetil Malmedal-Nes, his friend from the banking sector, and Lars Thomas Stene, his lawyer and business partner from another mobile venture. Together they formed the original founding team.

The idea:

Döderlein says the initial idea was simply to make it easy to pay and get paid, anywhere, using your mobile phone. “It has grown into a monster of a system where the easy to use consumer app is backed by a complex payments infrastructure connecting financial institutions, merchants, and consumers in a real time payment and information sharing network. So now we serve banks, merchants, and consumers,” says Döderlein.

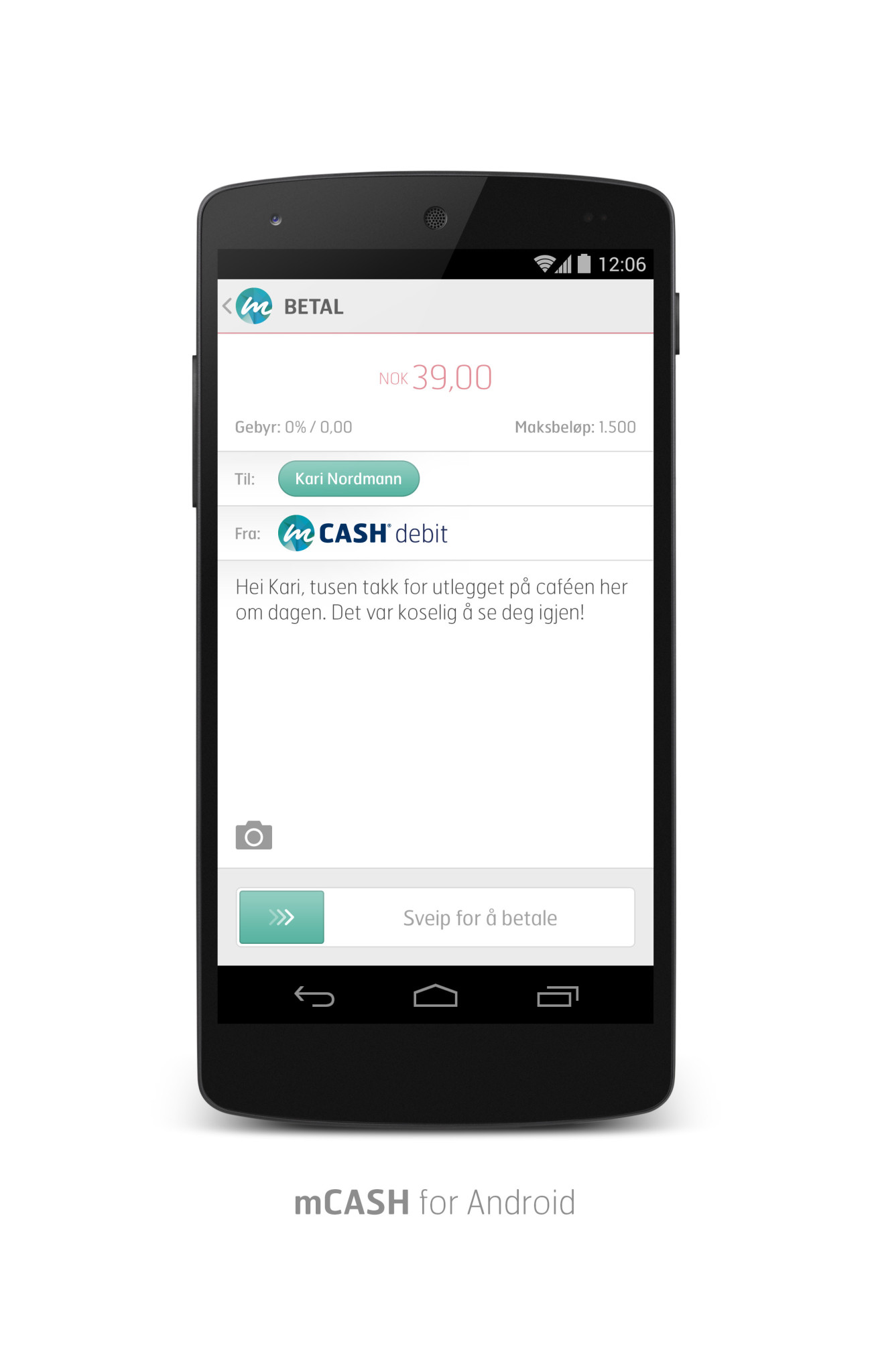

In a nutshell, mCash is an app that can connect your phone to all your money and pay to anyone, anywhere. It’s the mobile bank and a payment app to rule them all. For merchants’, mCASH is a brand new payment network, enabling easier, faster, cheaper and more intelligent payments in all channels. For banks, mCASH is a next generation payment service that enables the bank to meet the growing demand for easy to use mobile payment services, including p2p payments, and offering merchant services that outperforms those of the old card schemes.

Döderlein says the key differentiator lies in the fact that most of the mobile payment services offered are based on the old rails, but mCASH has built new rails that are more efficient for both banks and merchants. This reduces the cost of transactions for merchants while increasing the transaction revenue (as a result of reduced cost or fewer sharing parties) for the banks. “We are not makeup on a pig, we are a whole new animal all together,” says Döderlein.

Getting it to work:

Starting mCash was tough, and the founding team worked for free for a long time. The startup managed to get some industry savvy angels to back them before they finally had a product they could show to the VC’s and close some serious bucks.

Besides the money mCash raised from angels, the company has received 43 Million NOK (about 5 million Euro at today’s rate) in VC funding (Series A) from NorthZone and Entre Capital.

Investor interest for mCash stems from the fact that the app allowed a user to conduct instant p2p payments from their phone, from any funding source, and send the money to a mobile phone number or a bank account. “You can pay by the click of a button on websites and inside apps and share shipping address where you want to. For merchant payments in store, it works on all phone types without having to validate if you have the right phone, Telco, card, etc, “says Döderlein.

This network and device agnostic service is free for consumers, and merchants pay less than what they do for cards while getting access to new sales channels and customer insight. “We earn money as banks pay for transaction processing (but less than what they do for with cards) and merchants pay a transaction fee too. We also sell small data (that is shipping address as an example),” says Döderlein.

Evolution:

Döderlein says the popularity of mobile payment systems are on the rise because they introduce new channels or ways for merchants to reach (and sell to) their customers. This then drives adoption. “The merchant can incentivize you to try new things. If what you deliver is good, and the merchant pushes it, the customers will stick to it. This is why I’m skeptical to the adoption of the NFC based solutions as up till now they don’t provide any added value for anyone. In fact it’s more expensive, it’s slow, it’s hardware dependant, it does not address a new market or audience. It’s the same cake, the same payment just more complex as you need to adapt a new habit without getting anything in return,” says Döderlein.

Döderlein says going ahead , merchants will lead the way as they need new ways to sell – more than the incumbents of the banking industry who also need a new system, as cards and other methods are expensive to implement and do not bring any new revenue.

“This is why CurrentC, although far from perfect, lacking a good UX and the privacy issues from the start, is so interesting, as it is driven by a new fraction. These are the merchants and not the banks or the card schemes or the consumer tech giants (Apple & Samsung),” says Döderlein.

Too many cooks?

Döderlein admits that this marks the start of a fragmentation that will be hard to avoid over the next few years. “Each country or region will do their own thing and probably be largely successful. Look at MobilePay in Denmark, Swish in Sweden, and mCASH in Norway. All proprietary schemes focusing on local conditions, solving for the customer and ignoring the industry lag. After all, you do 99% of your payments where you live so the need for a global standard is not eminent. It will eventually interconnect and that’s why Ripple and other interconnecting infrastructures and block chaining is a good place to invest,” says Döderlein.

Döderlein predicts that the local or national innovations will be dominant for the next few years while the big boys will play around with NFC for a while more, “beating that dead horse for as long as the industry is willing to burn money on terminals and hardware solutions.”

Döderlein goes on to add that such fragmentation is good, as it drives innovation and creates an extremely competitive marketplace where many will lose. “From a theoretical point of view one may argue that consumers and merchants will be uncertain in this chaos of options, but that’s not the case. The giants worked for years trying to push NFC, but the claimed reinvention of the old rails failed so monumentally that you get seasick if you now read the Gartner reports for the last five years, as they sway from side to side,” says Döderlein.

He adds that at the end of the day consumers don’t care if it says Visa or Dancard or mCASH on the sticker as long as it works, is perceived as safe, and brings some value or relevance over the old alternative. “Scandinavia has proven it and the rest of the world will follow. Cards will die,” says Döderlein in his prophecy.

Nordic Startup News Early Stage Startup News From The Nordics

Nordic Startup News Early Stage Startup News From The Nordics