Fintech companies have been a hot topic in the Nordics as startups rush to disrupt the traditional financial sector. Here is a look back at some of the main fintech trends and Nordic companies to watch in 2015.

Bitcoin

Bitcoin reached a big milestone in 2015, when it scored a major win in Europe by earning EU tax free status. This signifies that the cryptocurrency is beginning to shed its outlaw status in the eyes of regulators.

With bitcoin garnering more legitimacy around the world, financial institutions have become more interested in the technology behind it: blockchain.

Now, multinational companies like IBM, Intel, and JP Morgan have joined forces to create the Open Ledger Project, with the goal of re-imagining how ownership and value are exchanged in a digital economy. With banks looking to bring blockchain from a buzzword to a strategy, bitcoin startups can expect all eyes to be on them as the innovators in this technology.

Danish startup Strawpay has created a payment network offering effient and secure microtransactions on blockchain. Coinify, also from Denmark, is a platform that allows merchants to accept bitcoin and blockchain payments and get paid in their local currency, as well as a place for traders of bitcoin to convert their local currency into bitcoins and vice versa.

But bitcoin startups are moving fast from forward-thinking merchants and traders to the “real world”.

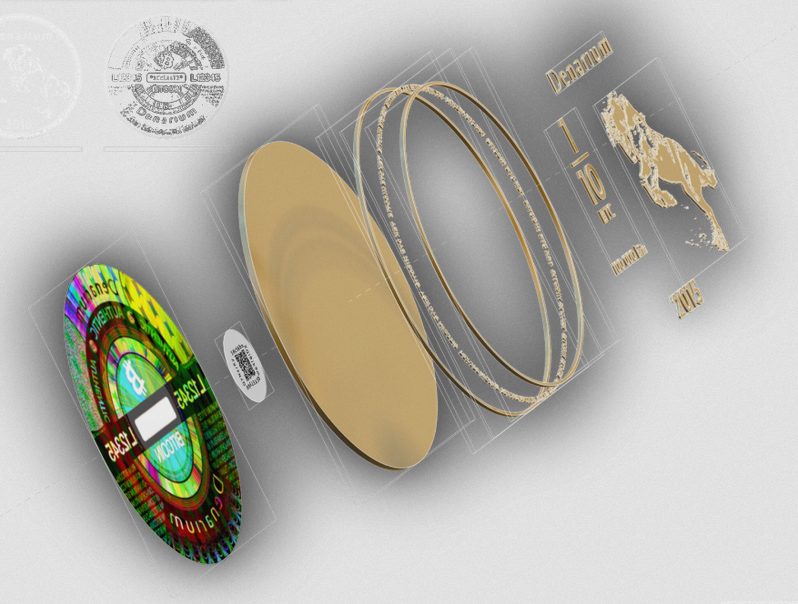

Finland’s Denarium has taken bitcoins out of the digital realm by launching a physical coin which has actual bitcoin value inside.

And Sweden’s Safello, which also operates an online bitcoin exchange, has partnered up with Barclay’s to “explore how blockchain can be used in traditional finance.”

Crowdfunding

The crowdfunding sector is becoming larger and more varied, thanks to growing momentum of the crowdfunding movement and regulatory changes.

The 2015 Crowdfunding Industry Report (2015CF), which quantifies crowdfunding globally, reported that crowdfunding platforms raised $16.2 billion in 2014, a 167% increase over 2013, and will continue to grow exponentially. In fact, Forbes reported that crowdfunding will surpass VC investment in 2016.

Skyrocketing growth in Asia was also critical to crowdfunding’s takeover, with the South China Morning Post recently reporting that there are 128 crowdfunding platforms in the country, 32 of which are equity based.

With growth comes regulation, which was on the agenda for many European countries in 2015, including Germany, Spain, and Italy, who all adopted crowdfunding rules over the past year.

The US Securities and Exchange Commission also issued a new regulation governing equity crowdfunding as part of the JOBS act, which allows companies to raise max of 1 million USD over a 12 month period.

The Nordic region now has close to 20 crowdfunding platforms, many with high success rates. Iceland’s Karolina Fund surpassed Indiegogo and Kickstarter combined in terms of successfully funded campaigns, with a 70.9% success rate, and Finland’s Invesdor had a 78% success rate in 2015. Invesdor was also the first crowdfunding platform to be granted a MiFID (Markets in Financial Instruments Directive) license, which allows it to operate across all 31 EEA countries with ease.

Meanwhile, advocacy groups like the Nordic Crowdfunding Alliance and Crowdsourcing Week are working to scale up national crowdfunding platforms to reach larger audiences – and thus a larger pool of investors and customers.

Cybersecurity

As technology makes finance more convenient, it can also make it riskier. Banks are getting more sophisticated, and so are hackers. Earlier this year, the security firm Gemalto reported 49% increase in the number of data breaches worldwide, and a 78% increase in data records being lost or stolen.

Startups are now moving to fill in the security void. In July, CB insights reported that the cybersecurity sector had attracted 4.6 billion in investment over the past 2 years, a quarter of which came in the first half of 2015.

Currently, there are fintech platforms that deal in fingerprints, facial recognition, voice recognition, retina scan, and even palm vein recognition.

The Nordic countries are home to many companies in the cybersecurity realm. Networked identity verification platforms, such as Iceland’s Authenteq, provide online users with a verified identity. Sweden’s Behaviosec and Castle, a Danish startup, analyze aspects of user behavior such as browsing habits and UI interaction to identify suspicious behavior. Encrypted file sharing and communications have been tackled by startups such as Denmark’s Rushfiles and Norway’s Crypho. And companies like Swedish Detectify create tools that audit websites by “hacking” them to determine security weaknesses.

We can expect in 2016 that cyber security space will grow to keep up with the demands of an increasingly diverse and risky fintech ecosystem.

Additional reporting by Andrew Woodman for Nexchange.

Nordic Startup News Early Stage Startup News From The Nordics

Nordic Startup News Early Stage Startup News From The Nordics

2 comments

Pingback: Fintech 2015 – Bitcoin, crowdfunding, og cybersikkerhed | Trendsonline.dk

Pingback: Journalistikken fejlede - ikke Bitcoins - Trendsonline.dk