Holvi – Banking for small businesses

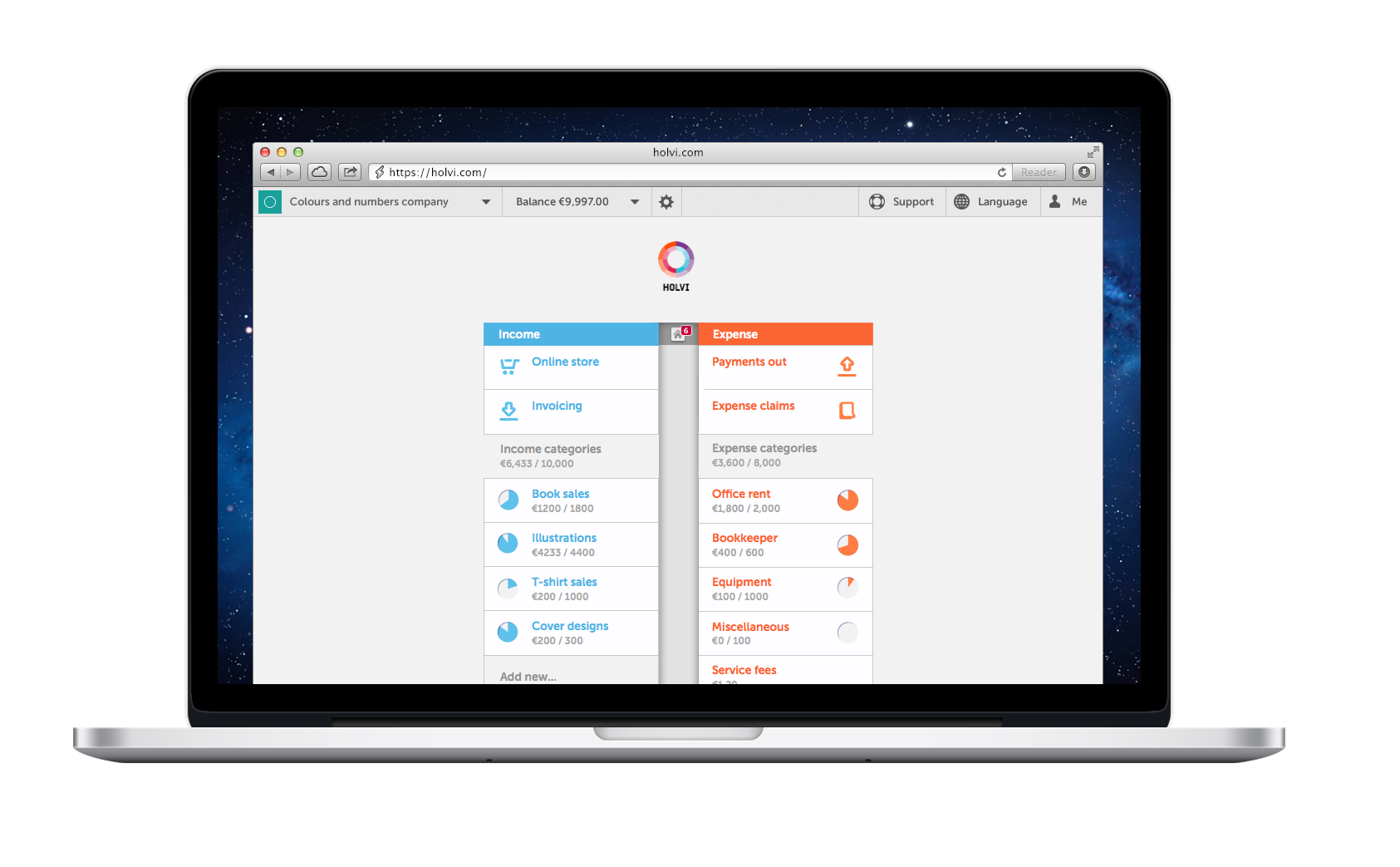

There are 40 million small business owners in Europe alone. The one thing they all got in common is that every small business needs a bank account, as well as tools to take care of their business. Holvi is looking to fill that need.

Currently there are 40 million small business owners in Europe, making the micro business segment the fastest growing macro segment in Europe. SME’s (Small and Medium-sized Enterprises) all need a bank account, as well as the tools to care for their business.

SME’s use approximately 6.8 hours on business administration per week, and share the same frustration about it. In the future, more and more people will be creating small business, and they need the right kind of financial tools to help them grow.

Makes the life easier for small business owners’

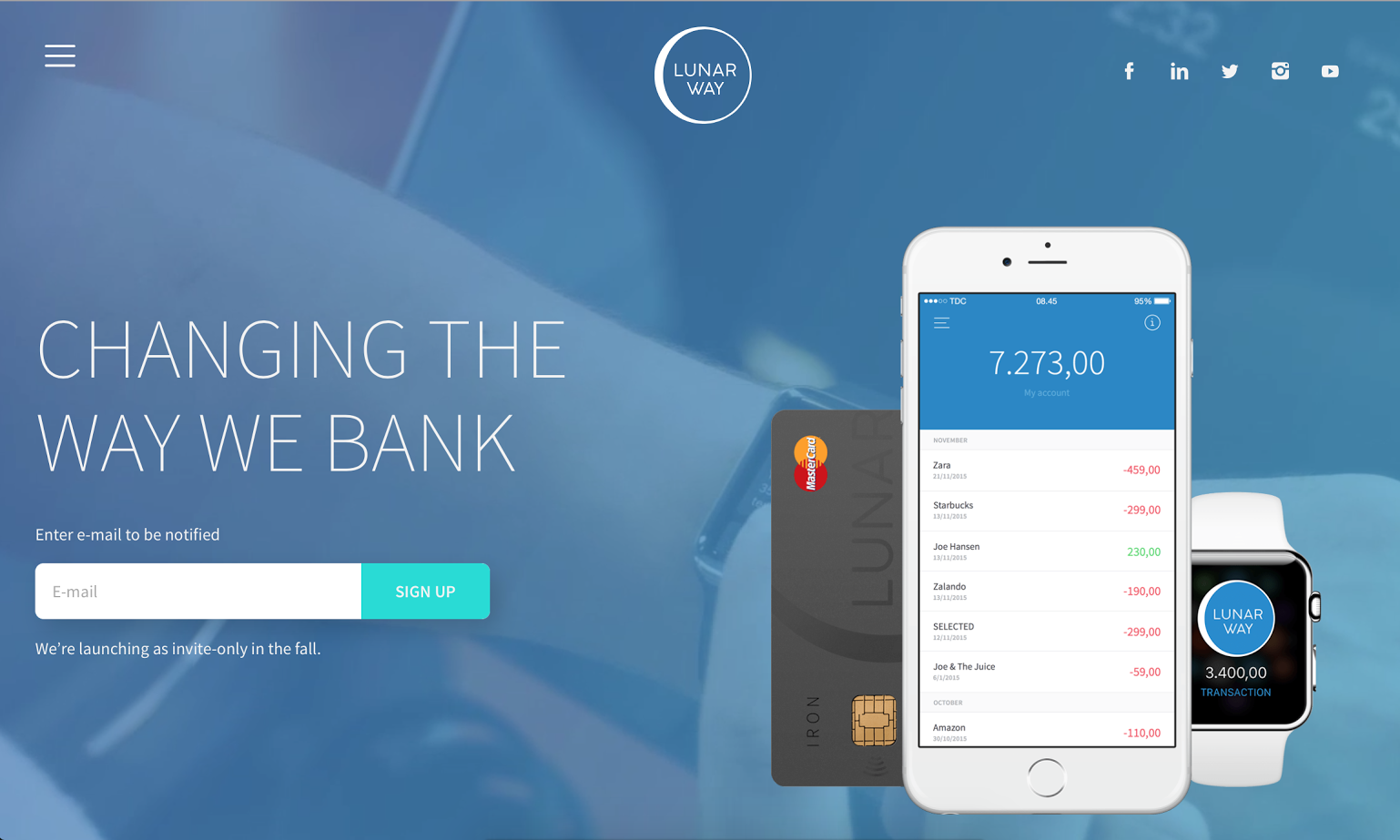

Holvi is a Finnish startup founded in 2011, with the goal of combining modern technology and user experience in banking. They have created an easy to use and manage bank account, which combines all the needs of small businesses in one place.

A Holvi account makes small business owners’ life easier, by combining online payments, modern usability and small business tools to a traditional account, essentially creating a one-stop-shop where it is possible to manage your business as well as your finances in one place.

“We are building the bank account and epicenter for the modern economy that connect all forms of payment methods, data, transactions and alternative financing. The most important unclaimed position of the banking space,” explained Johan Lorenzen, CEO of Holvi.

Holvi is the first pan-European bank replacement operating with its own Payment institution License. The infrastructure is built independently, and does not operate at the legacy backend of any existing bank. They focus on usability, design and the use of mobile apps, and believe that the core element of future banking is real value brought by real people.

“Traditional banks cannot do this in the long run. We are not just another layer on top of something existing; we built the core ourselves.”

Not afraid of mobile solutions

Holvi is not afraid of mPOS (Mobile Point-Of-Sale) such as mobile payments, cloud accountings and other financial services. They see them as compliments that can help build the ecosystem, and not as competition.

“We aim to become the foundation the bridges the money management between all the different solutions,” tells Johan Lorenzen, CEO of Holvi.

Holvi created the centerpiece that is the modern bank account. They bring together payment and data, no matter what type of method you prefer to use. Holvi got many inbuilt tools, but also offer its users to integrate other digital services if they like.

Holvi has recently made the FinTech50 2015, a list over the fifty hottest FinTech (Financial Technology) startups.

“It is always exciting for us to be acknowledged, and we will contribute to shape the future of banking, together with the other brilliant Fintech companies.”

This article is written based on a blog post by Holvi.