Both Nets and Cashbackpoint.dk has entered the battle for loyalty programs directly for the Danish payment card Dankort. Simply put the new services offer to collect the consumers’ entire range of customer loyalty cards in the Dankort.

Loyalty clubs are often associated with overfilled wallets and a long line waiting behind the customer who is eagerly trying to find the right card for the shop assistant. Numbers from the Union for Danish E-commerce (FDIH) shows that 81 percent of women have at least one loyalty club card. For men the number is 63 percent. However, the same survey shows that the Danes don’t feel like they are obtaining real value or savings by being member of a loyalty club – but maybe this scenario will change soon?

Within very short time we have witnessed strong players like for instance Nets and Cashbackpoints.dk enter the battle for creating loyalty programs directly for the Dankort. Both webshops and physical stores can now attach their loyalty or customer programs directly to the Dankort. This means that the customers automatically obtains discounts and benefits as they pay with their Dankort.

“There is no doubt that there is strong competition among the loyalty clubs for obtaining some of the space in the customers’ wallets and not least their awareness, so that the sales activities can be increased. And in order to win this battle the survey clearly shows that theres is a need to increase the value for both men and women across the physical and digital channels”, says Anette Faldberg, CEO of FDIH

CashbackAPP – a loyalty program for both customers, retail and ecommerce

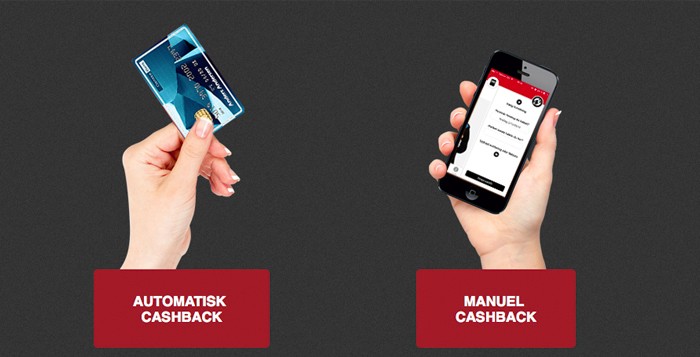

As soon as a customer has signed up for cashbackAPP he or she is ready to receive the reward that he or she wants the most, namely money. In contrast to other loyalty programs with rewards like stamps, stickers or points the reward here is paid out in cash directly to the customer’s private bank account.

The customer just has to download the cashbackAPP and sign up the payment card. Immediately after this it is possible to receive offers and see in which physical and online stores the cashback reward is available. cashbackAPP has experienced a great welcome by both the self-employed retailers and among a lot of the great chains.

All webshops using ePay payment gateway system can now hook up to the program and thus offer Dankort and other payment cards as loyalty cards to their customers.

Purchases via Mobile Pay can also be registered and thus rewarded if the customer’s Dankort signed up for Mobile Pay is also signed up for cashbackAPP.

“For the self-employed shops it is often a too great investment to build up their own loyalty program. And those who do it don’t obtain the valuable customer information that the great chains profit by. A retail shop who wishes to become part of “the cashback universe” just apply at cashbackpoint.dk. Within short time and without any start investment the shop has a loyalty program and a very desirable marketing platform at cashbackAPP.” Tells manager Nikolaj Veje Rasmussen

Nets also enters the battle for the customer club cards

Paying with Dankort must be easy, simple and not least efficient. This is why we have chosen to give businesses and providers of loyalty concepts the possibility to hook up their loyalty programs directly to the Dankort – to the delight of both themselves and not least their customers, who no longer have to bring along and register their loyalty cards every time they pay, says Mette Munck, senior manager at Nets with responsibility for the Dankort, in a declaration.

In Nets’ solution the shops have to pay a quarterly fee of up to 50 Danish øre (0.07 EUR) per customer who has signed up a Dankort for the loyalty program. The price will however depend on the number of cards attached to each business. However, Nets believes that this expense is offset by the savings that the shop would otherwise defray on issue and administration of their own loyalty cards plus reduced processing time.

Grocers see opportunities

The Danish Federation of Grocers sees opportunities in the new solutions.

“This new functionality on the Dankort is an exciting new opportunity for businesses who use loyalty programs. It can contribute to keeping the businesses’ expenses down and it will give the end customer a higher convenience and a higher incentive to use the Dankort rather than other payment methods. In the end this is an advantage for all concerned.” Says CEO John Wagner

Today more than five million Dankort and Visa/Dankort have been issued and in 2014 more than 1.1 billion payments wih Dankort was carried out in Danish shops.

The article was originally published on Shopsonline

Nordic Startup News Early Stage Startup News From The Nordics

Nordic Startup News Early Stage Startup News From The Nordics